ClearPath Advisors

Protecting What Matters Most:

Health & Finances

At ClearPath Advisors, we are dedicated to helping individuals and families navigate life’s most important financial and healthcare decisions. We specialize in Medicare Health Insurance, Retirement Planning, and Financial Resources designed to give you peace of mind and long-term security.

We understand that both Medicare and financial planning can feel overwhelming, which is why we take a personalized approach. From comparing Medicare plans to exploring life insurance, annuities, and other financial solutions, we work one-on-one with you to create a clear path forward that fits your needs, goals, and budget.

What sets us apart is our commitment to your overall well-being. We take the time to listen and understand your unique situation so we can provide tailored guidance—whether you’re planning for retirement, protecting your family with insurance, or navigating your healthcare coverage.

At

ClearPath Advisors, our mission is simple: to simplify complex choices and empower you with the knowledge to make confident decisions for your health and financial future.

Applications & Resources for applying for Medicare

Frequently Asked Questions

What is Medicare?

Medicare is the United States federal health insurance program for people who are 65 or older. It’s also available for people who are younger than 65 and have been diagnosed with certain disabilities or health conditions such as End-Stage Renal Disease (ESRD) or Lou Gehrig’s disease (ALS).

That’s a pretty straightforward definition, but there is a lot to the Medicare program, and many beneficiaries are still confused about it long after their enrollment. Our goal is to simplify your Medicare for your peace of mind!

Medicare was originally created in 1965. President Lyndon Johnson signed the Medicare and Medicaid Act into law. The act established Medicare as a way for retired individuals to get health insurance. It also created Medicaid, which is often confused with Medicare. Medicaid is also a health insurance program, but it is designed for people with limited incomes rather than based solely on age.

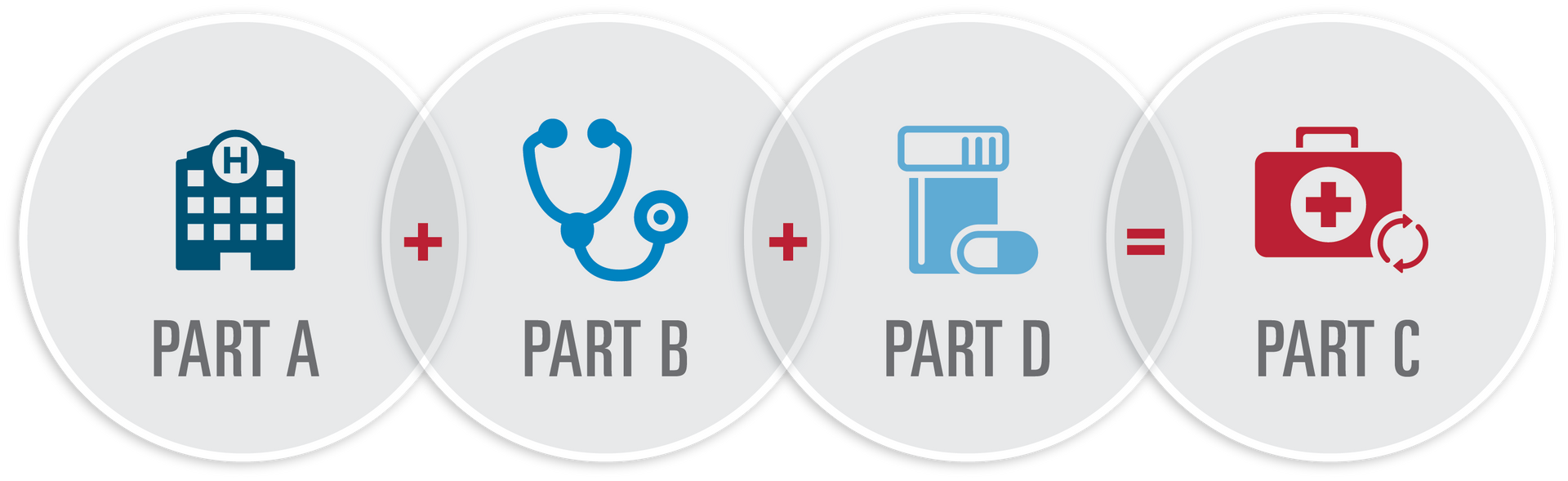

The Medicare program consists of four parts, plus some other options for additional coverage. While everyone starts with Parts A and B, the rest of your coverage options will be a personal decision based on your healthcare needs and budget.

How Does Medicare Work?

Let’s start talking in more detail about each part of Medicare and the supplement coverage offered to Medicare beneficiaries.

Original Medicare

Original Medicare includes Part A and Part B. It’s sometimes called Traditional Medicare. Original Medicare is where everyone starts. You must enroll in both Parts A and B before you can choose any additional coverage.

Medicare Part A is also called inpatient or hospital insurance. It covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Most beneficiaries don’t pay a premium for Part A. As long as you or your spouse have worked and paid taxes for ten years (40 quarters), you won’t pay a premium for Part A. If you haven’t met that requirement, your premium is based on the number of quarters you’ve fulfilled. Premiums typically change (increase) every year.

Even though Part A doesn’t have a premium, it does have other out-of-pocket costs. First, it has a deductible. The Part A deductible works differently than other health insurance deductibles you might be used to. Instead of an annual charge, it goes by benefit periods. A benefit period begins on the first day you become an inpatient and ends when you’ve been out of the hospital (or other facility) for 60 consecutive days.

Part A also has copays, which are based on the number of days you’ve been hospitalized. The first 60 days of a hospitalization are covered by Medicare. Copays begin on day 61.

Medicare Part B is also called outpatient or medical insurance. It covers visits to your doctor, imaging, lab tests, surgeries, durable medical equipment, and many preventive care services.

Part B does have a monthly premium. The Centers for Medicare and Medicaid Services (CMS) sets a standard premium each year. Most people pay the standard amount, but people with higher incomes will pay more. On the other hand, beneficiaries with limited incomes are eligible for Medicare Savings Programs, which can help cover the Part B premium.

Part B also has a deductible, but it is a smaller annual fee. Once you meet that deductible, Part B pays for 80% of covered services, leaving you with a 20% coinsurance amount.

Unlike traditional group health insurance, there is no out-of-pocket maximum under Original Medicare. While it does offer great coverage, it can leave beneficiaries with a large financial burden.

This is where we come in to fills the gaps where original Medicare leaves off to ensure you are protected for all of your health and wellness needs!

What financial services do you offer?

We provide retirement planning, annuities, indexed universal life (IUL), and strategies for protecting and growing your wealth.

How do annuities work?

Annuities are insurance products that can provide steady income during retirement. They help protect against outliving your savings.

Do I need a large amount of money to start retirement planning?

Not at all. We work with individuals and families at all financial stages to build a plan that fits their situation.

What is Indexed Universal Life (IUL) insurance?

IUL combines life insurance with the potential to build cash value linked to a market index, offering flexibility for protection and growth.

Does it cost anything to meet with an advisor?

No — all of our consultations are completely complimentary! At ClearPath Advisors, we believe everyone deserves access to clear, unbiased guidance when it comes to Medicare and Financial planning.

Even if you decide not to move forward with a plan, there’s no obligation or fee for meeting with us. Our role is to educate, answer your questions, and make sure you fully understand your options so you can make confident decisions. Think of us as a trusted resource — here to simplify the process, not sell you something you don’t need.

Free Consultation

Send us your contact details and we’ll schedule a 1-on-1 with one of our professionals